- Missed trade Tuesday due to emotions: -150.00

- Reversal out of Standard setup on Thursday: -250.00

- Total Cost of Mistakes: -400.00

And as far as our new setup. Traded this week correctly it had a 88% win rate (I caught the only loser yesterday! lol!) and +450.00 in profits net. I don't consider that lost profit however because that wasn't in my trade plan until yesterday. But that one setup alone has been good for about 80% win rates and over +1700.00 in profits over the past three weeks by itself. Its going to be a great addition to my arsenal.

So lets talk about where we go from here. Obviously next week we are going to aim at achieving that perfect execution week. Employing all of our setups, taking the correct ones, and most importantly - managing them correctly. I have one last week before the first month of trading is over and my goal of making $2,000.00 in profits is a pipe dream at the moment. Traded correctly? That goal would not only have been met right now, but exceeded. I conservatively estimate that i've left over $2,500.00 on the table this month so far from mismanaged trades, not taking +1 ticks to cover commissions, incorrect signals being taken, and my two new trade setups I added this month. But what we have to realize is that the past is the past and you can't do anything about it in the present. So we are moving forward. But if you think for one moment I don't believe that goal of $2,000.00 by February 6th is still possible from my actions next week you would be dead wrong. We are going to get there or do our damnedest failing to do so.

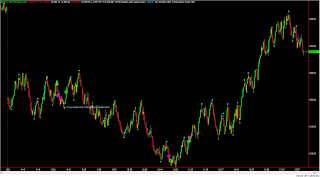

My weekend project is simple - find out if trading prior to 9AM trading only my support and resistance setups in the market would be worth it. Today for example there was an easy +5 points available. On the 22nd there was an easy +4.5. All textbook DB/DT or You're Screwed setups that I pass on due to the time. I still contend some of my other setups should not be traded in those time periods but the support and resistance setups seem to be very consistent there. So i'm going to do some extensive backtesting and see what the probabilities are for allowing those two setups to trade during that time period.

And despite all of this. We made money this week. We're doing something right, even if we are still doing some things wrong.

Trade Results:

No Trades Taken.