As traders we need to understand that our methods have a probability of outcome and to achieve that probability we as traders need to execute our plans correctly throughout the day. If we do that the method succeeds. If we don't, the method fails. As long as you took the signals and followed your rules you traded perfectly regardless if that nets you a losing day or losing week. Systems have drawdowns, trades stop out. The point is successful traders separate the outcomes of profit from the outcomes of their performance.

As for today. I traded my nuts off. The most trades i've ever taken in one day is 4. I had taken 8 by 12:30 in the afternoon. Too many to go through individually but lets just say the trading gods didn't favor me in the am. I start trading at 9AM CST - by 9:04 I was down -225.00 on two back to back losers and by 9:22 up +25.00 net on one winner. This back and forth P/L whipsaw continued throughout the day. All I know is that I traded like a champ. I missed one signal that went for big gains but that's just going to happen. I was bidding for it but I got greedy by a tick and missed my fill on a trade that went the better part of 6 points. DON'T GET GREEDY. As I type this I hit exactly 50% "winners" today, two of which were par, one of which I got slipped on the exit for a tick and i'm still net profitable. Another trade that was a loser literally tagged me out on the tick low before going immediately to my profit target - but it happens! GOOD TRADING IS TAKING THE SIGNAL.

Now I did do something a bit unorthodox for myself today, and that was to quit early. I stopped trading at 1:30 rather than 2:30. Now this *IS* against my rules but I did this for two reasons. Today I took 2x's the trades I normally take on a day and frankly, i'm emotionally and psychologically drained. My focus is lacking as I write this post and I have no want to sit at the screens anymore. Secondly, the market has just gone ape shit in the last hour and shot up 20 points in a straight line. While there could be opportunity here, this puts price action into an "outlier" category which diminished my edge somewhat. So maybe i'll miss out on nice profits, but i'm willing to accept that outcome right now. I'm just not in the mindset to put on more trades anymore today.

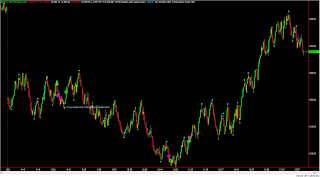

Because I am so tired I will merely give you my two charts I traded and the arrows that indicated the trades... A lot of the trades are Double Tops or Double Bottoms so take a look and see what I did.

*Update 6:32 PM* Turns out there was one more valid signal that worst case would've been par (+1 tick) but it came up to my target level exactly but I can't guarantee that I would've gotten filled (or that I would've gave up a tick to get out) so we'll call it even. Worst case I missed one trade.

Trade Results:

+112.50

2 comments:

Nice observation about trading success vs. failure as per the P&L. However this is only true under the assumption that the gains and losses were directly tied to proper execution. If on the other hand, we break rules and experience a drawdown as the result, we can certainly blame the p&l on ourselves. But I get your point and it is a good one. I am definitely guilty of rating my performance on my p&l and that's not the right way to evaluate performance.

Cheers,

Stan

My "Oh Shit" fund will just be a cache of around 20k that would be kept in a separate account to be used if I were to blow out an account or some kind of disastrous order platform failure that sticks me in a position I can't exit (i've had it happen before).

Basically, a fund that I can comfortably get back to trading a couple lots and start over if the worst should happen.

Post a Comment